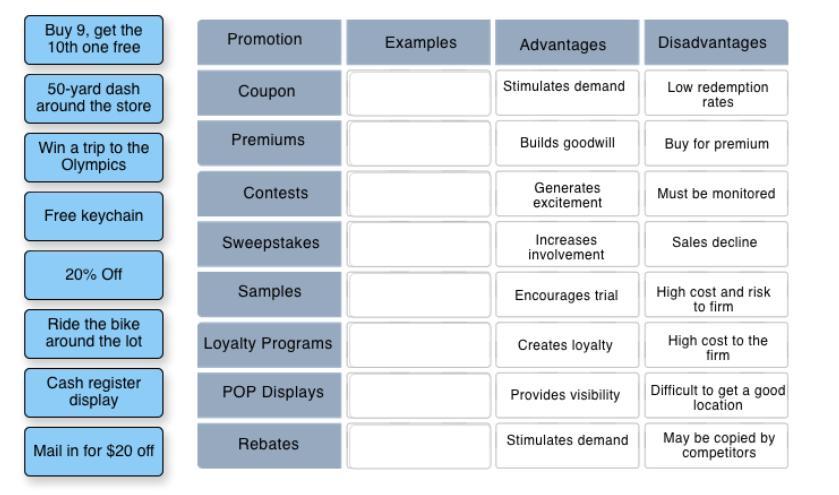

Roll over the items and match the examples to the sales promotion type.PromotionExamplesAdvantagesDisadvantagesCouponPremiumsContestsSweepstakesSamplesLoyalty ProgramsPOP DisplaysRebatesStimulates demandBuilds goodwillGenerates excitementIncreases involvementEncourages trialCreates loyaltyProvides visibilityLow redemption ratesBuy for premiumMust be monitoredSales declineHigh cost and risk to firmDifficult to get a good locationMay be copied by competitors

Answers

Answer:

Coupon ⇒ 20% off

Premiums ⇒ Free Keychain

Contests ⇒ 50-yard dash around the store

Sweepstakes ⇒ Win a trip to the Olympics

Samples ⇒ Ride the bike around the lot

Loyalty Programs ⇒ Buy 9, get the 10th one free.

POP Displays ⇒ Cash register display

Rebates ⇒ Mail-in for $20 off

Related Questions

Kevin purchases 1,000 shares of Bluebird Corporation stock on October 3, 2020, for $115,000. On December 12, 2020, Kevin purchases an additional 750 shares of Bluebird stock for $80,500. According to market quotations, Bluebird stock is selling for $115 per share on 12/31/20. Kevin sells 500 shares of Bluebird stock on March 1, 2021, for $64,400.

Required:

a. What is the adjusted basis of Kevin’s Bluebird stock on December 31, 2020?

b. What is Kevin’s recognized gain or loss from the’ sale of Bluebird stock on March 1, 2021, assuming dial the shares sold are from the shares purchased on December 12, 2020?

c. What is Kevin’s recognized gain or loss from the sale of Bluebird stock on March 1, 2021, assuming that Kevin cannot adequately identify the shares sold?

Answers

Answer:a)$195,500 b) $10,735 c)$6,900

Explanation

a)adjusted basis of Kevin’s Bluebird stock on December 31, 2020?

1,000 shares was bought for $115,000

Therefore it was bought at $115 per share

Also

750 shares was bought at $80,500 and therefore bought at 107.33 per share

So in total of 1750 shares, He spent $195,500 ($115,000+ $80,500)

b.On December 12, 2020,he bought shares at 107.33 per share

500 shares would be 500 x $107.33=$53, 665

Therefore, Kevin’s recognized gain or loss from the’ sale of Bluebird stock on March 1, 2021 would be

$64,400- $53, 665 = $10,735

c.Assuming he cannot identify the shares sold, then we can say they are sold on a FIFO ( first in first out) basis. So we would consider the shares bought on October 3, 2020

so we have that

500 x $115=$57,500

$64,400 - $57,500 = $6,900

A company has developed a new gadget. If the gadget is successful, the present value of the payoff (at the time the product is brought to market) is $6.2 million. If the gadget fails, the present value of the payoff is $1.80 million. If the gadget goes directly to market, there is a 50 percent chance of success. Alternatively, the company can delay the launch by one year and spend $0.25 million to test-market the product. Test-marketing would allow the company to improve the product and increase the probability of success to 75%. The appropriate discount rate is 11%. Should the firm conduct test-marketing?

a. No, because NPV is lower by $0.25 million

b. No, because NPV is lower by approximately $0.31 million

c. No, because NPV is lower by approximately $0.11 million

d. Yes, because NPV is higher by approximately $0.34 million

e. Yes, because NPV is higher by approximately $0.19 million

Answers

Answer:

d. Yes, because NPV is higher by approximately $0.34 million

Explanation:

Calculation to determine whether the firm should conduct test-marketing

Calculation for Going directly to market:

Since there is a 50 percent chance of success First step is to calculate the Probability of failure

Probability of failure = 100% - 50%

Probability of failure = 50%

Now let calculate the NPV of going directly to market

NPV of going directly to market = 50% * $6.2 million + 50% * $1.80 million

NPV of going directly to market =$3,100,000+$900,000

NPV of going directly to market = $4,000,000

Calculation for Test marketing before going to market:

Since the probability of success is 75 percent the first step is to calculate the Probability of failure

Probability of failure = 100% - 75%

Probability of failure= 25%

Second step is to calculate Year 1 value

Year 1 value = 75% * $6.2 million + 25% * $1.80 million

Year 1 value=$4,650,000+$450,000

Year 1 value = $5,100,000

Now let calculate the NPV of test marketing before going to market

NPV of test marketing before going to market = $5,100,000 /(1 + 11%) - $250,000

NPV of test marketing before going to market=$4,344,595

Therefore based on the above calculation the firm should conduct test-marketing before going to the market because the NPV is higher by approximately $0.34 million ($4,344,595-$4,000,000)

Identify whether each of the following statements is or is not a provision of Occupational Safety and Health Act (OSHA).

a. Employers can be cited and fined for not complying with OSHA workplace standards.

b. OSHA is authorized to enter, after a one-month delay, any factory, plant, establishment, construction site or other areas, workplace, or environment where work is performed by an employee of an employer to inspect or investigate.

c. OSHA is authorized to inspect and investigate during work hours at any place of employment and all pertinent conditions and to question privately any employer, owner, operator, agent, or employee.

Answers

Answer:

a. PROVISION.

Under OSHA, an employee can be cited, fined or docked pay if they refuse to comply with the standards as these are to help save lives and maintain an accident free workplace.

b. NOT A PROVISION.

OSHA is authorized to act immediately and enter without any delay, into any workplace in order to investigate to see if they are enforcing OSHA provisions.

c. PROVISION.

In order to be as effective as possible. OSHA is allowed to inspect and investigate during work hours as well as off work hours in order to ensure that regulations are followed at all times.

Your friend Brian just graduated from medical school. He is excited to begin his new career but is worried about how he will be able to pay back his nearly $150000 in student loans if he were to become disabled. You have recommended a long-term own-occupation disability policy. Approximately how much will Brian pay per month in premiums for this type of policy if the monthly benefit is $6800

Answers

Answer:

$204

Explanation:

Monthly benefit = $6800

Monthly premium = monthly benefit * 3%

= 6800 * 3% = $204

Brian just graduated from school.

and under own occupation disability policy ranges between 1% to 3%.

since Brian is worried about his ability to pay back his student loan if he gets disabled we will assume that Brian has a higher risk to injury therefore he will most likely contribute more to his premium which ≈ $204

Which options are available when exporting a table definition and data? Check all that apply

Answers

Answer: 1. appending data to an existing table

4. creating a new table and inserting data

Explanation:

Jasmine owned rental real estate that she sold to her tenant in an installment sale. Jasmine acquired the property in 2008 for $1,840,000; took $644,000 of depreciation on it; and sold it for $1,012,000, receiving $101,200 immediately and the balance (plus interest at a market rate) in equal payments of $91,080 for 10 years. What is the nature of the recognized gain or loss from this transaction?

Answers

Answer:

The nature of recognized gain or loss from this transaction is known as capital gain or loss and its important for the computation of individual income taxes

Explanation:

Given the above information, the gain or loss on sale of real estate is computed as;

Original cost

$1,840,000

Less:

Depreciation

($644,000)

Current value of property

$1,196,000

Less:

Sales value

($1,012,000)

Loss on sale

$184,000

Here, there is loss on sale because sales is less than the present value of the property taken into consideration, hence a capital loss is recognized.

You are considering buying one of two types of health insurance, both with the same premium. You guess that in the next year there is a 1 percent chance of serious illness that will cost you $67,500 in health care, a 9 percent chance of a moderate illness that will cost you $2,500, and a 90 percent chance of regular health care needs that will cost you $500. One type of health insurance is emergency-only coverage; it will cover your expenses for serious illness but not moderate illness or regular care. The other type covers moderate illness and regular expenses, but its payout is capped, so it will not cover the cost of a serious illness.

Required:

a. What is the expected value of payouts from the emergency-only insurance? $.

b. What is the expected value of payouts from the capped-coverage insurance? $.

c. Which is the more risk-averse option?

Answers

Answer and Explanation:

The computation is shown below:

a. The expected value of payout arise from emergency is

= 0.01 × $67,500

= $675

b. The expected value of payout arise from capped coverage insuance is

= (0.9 × $500) + (0.09 × $2,500)

= $675

c. The risk averse shows the minimum exposure with respect to the swings of the income or there would be the loss in the income. Since the payout amount is same in both the cases so here we considered option B

An economy starts in a long-run equilibrium, but then a severe drought kills crops and dramatically increases the price of food. If the Federal Reserve wanted to stabilize the economy and return it back to full employment, it would Group of answer choices decrease the money supply, which would restore the original price level increase the money supply, but prices would forever be higher decrease the money supply, but prices would forever be lower increase the money supply, which would restore the original price level

Answers

Answer:

increase the money supply, but prices would forever be higher.

Explanation:

In this scenario, an economy starts in a long-run equilibrium, however a natural disaster such as drought kills crops and dramatically increases the price of food in the market. Thus, if the Federal Reserve wanted to stabilize the economy and return it back to full employment, it would increase the money supply, but prices would forever be higher.

The Federal Reserve System ( popularly referred to as the 'Fed') was created by the Federal Reserve Act, passed by the U.S Congress on the 23rd of December, 1913. The Fed began operations in 1914 and just like all central banks, the Federal Reserve is a United States government agency.

Generally, it comprises of twelve (12) Federal Reserve Bank regionally across the United States of America.

Like all central banks, the Federal Reserve is a government agency that is saddled with the following responsibilities;

I. The Fed controls the issuance of currency in United States of America: it promotes public goals such as economic growth, low inflation, and the smooth operation of financial markets.

II. It provides banking services to all the commercial banks in the country because the Federal Reserve is the "lender of last resort."

III. It regulates banking activities in the United States of America: it has the power to supervise and regulate banks.

Write a conversation between florist and customer for ordering a bouquet to gift for mom on Mother's Day - write with etiquette

Answers

Answer:

sorry sir you would have to do this on your own

Old Quartz Gold Mining Company is expected to pay a dividend of $8 in the coming year. Dividends are expected to decline at the rate of 2% per year. The risk-free rate of return is 6%, and the expected return on the market portfolio is 14%. The stock of Old Quartz Gold Mining Company has a beta of -0.25. The intrinsic value of the stock is

Answers

Answer:

$133.33

Explanation:

Cost of equity (Ke) = Rf + beta*(Rm-Rf)

Cost of equity (Ke) = 6% - 0.25*(14%-6%)

Cost of equity (Ke) = 4%

Cost of equity (Ke) = 0.04

According to the dividend distribution model Ke = D1/ P0 + g. P0 = D1/(ke-g, where D1 = 8, g = -0.02 and Ke = 0.04

P0 (Intrinsic price) = 8/(0.04+0.02)

P0 (Intrinsic price) = 8/0.06

P0 (Intrinsic price) = $133.33

Therefore, he intrinsic value of the stock is $133.33.

ABC Company has the following trial balances on 12/31/20x1 and 12/31/20x0: December 31 20x120x0 Cash35,00032,000 Accounts Receivable22,00018,000 Inventory31,00040,000 Property10,00010,000 Plant and equipment100,00082,000 Accumulated depreciation, plant assets(20,000)(14,000) Accounts Payable(25,000)(15,000) Other current liabilities(6,000)(5,000) Bonds Payable(50,000)(50,000) Common Stock(10,000)(10,000) Retained Earnings(40,000)(30,000) Dividends declared2,0002,000 Sales revenue(200,000)(184,000) Cost of Goods Sold120,000100,000 Selling expenses20,00015,000 General and administrative expenses10,0008,000 Interest Expense10001000 What is the cash outflow for merchandise

Answers

Answer and Explanation:

The computation of the cash outflow for merchandise is shown below:

Cost of Goods Sold $120,000

Less: Decrease in Inventory -$9,000

Purchases $111,000

Less: Increase in Accounts Payable -$10,000

Cash paid for Merchandise Inventory $121000

Hence, the cash outflow for merchandise is $121,000

The above format should be applied

Jayleen Company makes two products: Carpet Kleen and Floor Deodorizer. Operating information from the previous year follows. Carpet Kleen Floor Deodorizer Units produced and sold 6,000 5,000 Machine hours used 6,000 2,000 Sales price per unit $ 8 $ 13 Variable cost per unit $ 6 $ 10 Fixed costs of $38,000 per year are presently allocated equally between both products. If the product mix were to change, total fixed costs would remain the same. The contribution margin per machine hour for Floor Deodorizer is:

Answers

Answer:

$7.50 per machine hour

Explanation:

Calculation to determine what The contribution margin per machine hour for Floor Deodorizer is:

First step is to calculate the CM

CM = $13 – 10

CM= $3/ unit

Second step is to calculate Hours/ unit

Hours/ unit= 2,000 / 5,000

Hours/ unit= 0.4 hours

Now calculate the contribution margin per machine hour

Contribution margin per machine hour=$3/ 0.4 hours

Contribution margin per machine hour= $7.50 per machine hour

Therefore The contribution margin per machine hour for Floor Deodorizer is:$7.50 per machine hour

On January 8, Quastrar, Inc. sent Hylian Company a letter offering to sell $10,000 in restaurant supplies. On January 18, Hylian mailed a letter to Quastrar accepting the offer. Quastrar received the acceptance letter on January 20. On January 17, Quastrar sent a letter revoking the offer. Hylavian received this letter on January 21. A contract between Quastrar and Hylavian: A. was not formed because the revocation was effective before the acceptance was sent. B. was not formed because the revocation was effective before the acceptance was received. C. was formed on January 18. D. was formed on January 20

Answers

Answer:

C. was formed on January 18

Explanation:

Since in the question it is mentioned that On Jan 8, Quastrar sent the letter for selling the restaurant supplies to Hylian company for $10,000. On Jan 17, Quastrar sent the revoking letter offer and the same would be received by Hylian on Jan 21. On Jan 18, Hylian mailed the letter regarding the acceptance to Quastrar and the same would be received by Quastrar on Jan 20.

So, the contract between them would be created on Jan 18 as the acceptance is sent on Jan 18 i.e. prior the revocation letter

Eagle Company uses a standard cost system that has provided the following data: Units of output manufactured 90 Direct labor Standard hours allowed 2 hours per unit of product Standard wage rate $ 15.60 per hour Actual direct labor 200 hours, total cost of $3,520 The direct labor rate variance for the period was: Multiple Choice $712 favorable. $400 favorable. $400 unfavorable. $712 unfavorable.\

Answers

Answer:

Direct labor rate variance= $400 unfavorable

Explanation:

To calculate the direct labor rate variance, we need to use the following formula:

Direct labor rate variance= (Standard Rate - Actual Rate)*Actual Quantity

Direct labor rate variance= (15.6 - 17.6)*200

Direct labor rate variance= $400 unfavorable

Actual rate= 3,520 / 200= $17.6

Kenseth Corp. has the following beginning-of-the-year present values for its projected benefit obligation and market-related values for its pension plan assets.

Projected Benefit Obligation Plan Assets Value

2019 $2,000,000 $1,900,000

2020 2,400,000 2,500,000

2021 2,950,000 2,600,000

2022 3,600,000 3,000,000

The average remaining service life per employee in 2019 and 2020 is 10 years and in 2021 and 2022 is 12 years. The net gain or loss that occurred during each year is as follows: 2019, $280,000 loss; 2020, $90,000 loss; 2021, $11,000 loss; and 2022, $25,000 gain.

Using the corridor approach, compute the amount of net gain or loss amortized and charged to pension expense in each of the four years, setting up an appropriate schedule.

Answers

Answer:

10%Corridor

2011 $0

2012 $250,000

2013 $295,000

2014 $360,000

Accumulated

2011 $0

2012 $280,000

2013 $367,000

2014 $372,000

Minimum Amortization of Loss

2011 $0

2012 $3,000

2013 $6,000

2014 $1,000

Explanation:

Calculation to determine the net gain or loss amortized and charged to pension expense under the corridor approach

Year, Projected Benefit Obligation (a) , Plan Assets, 10%Corridor, Accumulated d OCI (G/L) (a), Minimum Amortization of Loss

2011 $2,000,000 $1,900,000 $200,000 $ 0 $0

2012 $2,400,000 $2,500,000 $250,000 $280,000 $3,000(b)

2013 $2,950,000 $2,600,000 $295,000 $367,000(c) $6,000(d)

2014 $3,600,000 $3,000,000 $360,000 372,000(e) $1,000(f)

Calculation for 10%Corridor

2011 $0

2012 10%*$2,500,000 =$250,000

2013 10%*$2,950,000 =$295,000

2014 10%*$3,600,000 =$360,000

Calculation for Accumulated Depreciation and Minimum Amortization of Loss

a. As at the beginning of the year

b. ($280,000 – $250,000) ÷ 10 years = $3,000

c. $280,000 – $3,000 + $90,000 = $367,000

d. ($367,000 – $295,000) ÷ 12 years = $6,000

e. $367,000 – $6,000 + $11,000 = $372,000

f ($372,000 – $360,000) ÷ 12 years = $1,000

Therefore the net gain or loss amortized and charged to pension expense under the corridor approach are :

10%Corridor

2011 $0

2012 $250,000

2013 $295,000

2014 $360,000

Accumulated Depreciation

2011 $0

2012 $280,000

2013 $367,000

2014 $372,000

Minimum Amortization of Loss

2011 $0

2012 $3,000

2013 $6,000

2014 $1,000

The 1255 people residing in the state of Oz want their yellow brick road repaved. It could be repaved with standard asphalt for a cost of $163403 or with shimmering gold asphalt for $8623195. The senator that represents Oz in the national legislature argues that the yellow brick road is a national treasure and a tourist attraction. As such, the senator argues that the nation of 4363963 people should pay for the repaving. Round your answer to two decimals for all of the following questions.

What is the cost per person if the national government pays for gold asphalt?

$ ________ /person

What is the cost per person if the state of Oz pays for gold asphalt?

$ ________/person

What is the cost per person if the state of Oz pays for standard asphalt?

$________/person

Which asphalt will likely be chosen if the residents of Oz?

a. gold asphalt

b. standard asphalt

Which asphalt will likely be chosen if the national bear the cost of repaving?

government bears the cost of repaving?

a. gold asphalt

b. standard asphalt

Answers

Answer:

Part 1

Option b, Standard Asphalt as it will cost less per person as compared to the Gold Asphalt.

Part 2

Option B, Standard Asphalt as it will cost less per person as compared to the Gold Asphalt

Explanation:

Given

Total Population of the nation = 4363963

Total population of the state of OZ = 1255

The cost per person if the national government pays for gold asphalt = $8623195/4363963 = 1.976 dollars per person

The cost per person if the state of Oz pays for gold asphalt =

$ 8623195/1255= $6871 per person

The cost per person if the state of Oz pays for standard asphalt =

$163403/1255 = $130 per person

Part 1

Option b, Standard Asphalt as it will cost less per person as compared to the Gold Asphalt.

Part 2

Option B, Standard Asphalt as it will cost less per person as compared to the Gold Asphalt

Crane, Inc., is preparing its direct labor budget for 2020 from the following production budget based on a calendar year.

Quarter Units Quarter Units

1 20,330 3 35,270

2 25,370 4 30,390

Each unit requires 1.70 hours of direct labor. Prepare a direct labor budget for 2020. Wage rates are expected to be $17 for the first 2 quarters and $19 for quarters 3 and 4.

Answers

Answer:

Total labor hour = Units*Operating hours

Labor cost= Total labor hours * Hourly wage rate

QUARTER

1 2 3 4

Units 20,330 35,270 25,370 30,390

DLH time per unit 1.70 1.70 1.70 1.70

Total labour hours need 34561 43129 59959 51663

Hourly wage rate 17 17 19 19

Budgeted direct labor hour 587535 733193 1138221 981597

5. Which of the following statements is false? A) The incentives come from owning stock in the company and from compensation that is sensitive to performance. B) The role of the corporate governance system is to mitigate the conflict of interest that results from the combination of ownership and control without unduly burdening managers with the risk of the firm. C) Punishment comes when a board fires a manager for poor performance or fraud, or when, upon failure of the board to act, shareholders or raiders launch control contests to replace the board and management. D) The corporate governance system attempts to align interests by providing incentives for taking the right action and punishments for taking the wrong action. E) None of the above

Answers

Answer: B) The role of the corporate governance system is to mitigate the conflict of interest that results from the combination of ownership and control without unduly burdening managers with the risk of the firm.

Explanation:

Corporate governance has to do with the combination of laws, rules, and processes through which businesses are being operated, regulated. Corporate governance comprises of both the internal factors and the external factors which has an impact on the interests of the stakeholders in the company.

From the options given, the option that is false is B. It should be noted that the role of corporate governance system isn't about mitigating conflict of interest which arises from the combination of ownership and control.

Corporate structure may be defined as

A. the way a corporate building is structured

B. whether a company pays corporate taxes

C. the method a company uses to pay its employees

D. the way a businss is organized

Answers

Answer:

it is D. the way a business is organized

Explanation:

The corporate structure consists of several strata of positions with their own specific responsibilities within the company.

The end result of each position will be integrated with one another and all of them will contribute to whether company manages to achieve its goal or not.

If you advertise and your rival advertises, you each will earn $4 million in profits. If neither of you advertises, you will each earn $10 million in profits. However, if one of you advertises and the other does not, the firm that advertises will earn $1 million and the non-advertising firm will earn $5 million. If you and your rival plan to be in business for only one year, the Nash equilibrium is: _______.

a. for your firm to advertise and the other not to advertise.

b. for neither firm to advertise.

c. for each firm to advertise.

d. None of the answers is correct.

Answers

Answer:

D. None of the answers is correct.

Explanation:

On the first day of 2021, Paccar had 100,000 shares of common stock outstanding. The following transactions occurred during 2021: March 1: Reacquired 2,000 shares, accounted for as treasury stock. September 30: Sold all the treasury shares. December 1: Sold 11,000 new shares for cash. December 31: Reported a net income of $287,750. Required: Calculate Paccar's basic earnings per share for the year ended December 31,

Answers

Answer:

Paccar

Earnings per share for the year ended December 31

= $2.59

Explanation:

a) Data and Calculations:

January 1, 2021:

Outstanding shares of common stock = 100,000

During 2021:

March 1 Treasury stock 2,000 shares

September 30 Treasury stock (2,000) shares

December 1 Issue of 11,000 new shares

December 31: Outstanding shares of common stock = 111,000

Reported net income = $287,750

Earnings per share for the year ended December 31 = Net income/Outstanding shares of common stock

= $287,750/111,000

= $2.59

Budgeted sales of the East End Burger Joint for the first quarter of the year are as follows:January...................................................... $50,000February ..................................................... 60,000March ....................................................... 68,000 The cost of sales averages 40 percent of sales revenue and management desires ending inventories equal to 25 percent of the following month’s sales. Assuming the January 1 inventory is $5,000, the January purchases budget is: a. $19,000 b. $21,000 c. $31,000 d. $69,000

Answers

Answer:

b. $21,000

Explanation:

Calculation to determine what January purchases budget is

PURCHASES BUDGET

Requirements for January $20,000

($50,000 x 0.40)

Add Desired January 31 inventory 6,000

($60,000 x 0.25 x 0.40)

Total requirements $26,000

($20,000+$6,000)

Less beginning inventory ($5,000)

January purchases budget $21,000

($26,000-$5,000)

Therefore January purchases budget is $21,000

Presented below is information related to Ricky Henderson Company.

Cost Retail

Beginning inventory $ 282,140 $ 291,600

Purchases 1,425,000 2,144,000

Markups 92,300

Markup cancellations 17,400

Markdowns 37,900

Markdown cancellations 6,100

Sales revenue 2,346,000

Compute the inventory by the conventional retail inventory method.

Answers

Answer:the inventory by the conventional retail inventory method=the cost of Ending inventory becomes == $90,236.

Explanation:

Inventory computed for Ricky Henderson Company

Using the conventional retail inventory method, we have

Cost Retail

Beginning of Inventory $ 282,140 $ 291,600

Purchases 1,425,000 2,144,000

Total 1,707,140 2,435,600

Add:

Net Markups 74,900

(Markups -Markup 92,300 - 17,400)

cancellations)

Total 1,707,140 2510500

Less:

Net Markdown 31,800

(Markdowns -Markdown (37,900 - 6,100)

cancellations)

Sales price of goods 2,478,000

Sales revenue 2,346,000

The retail ending 132,700

(Sales price of goods-Sales revenue)

Therefore,

The retail cost ratio is = 1,707,140 /2,510,500=0.68= 68%

Hence, the cost of Ending inventory becomes = 132,700 x 68%

= $90,236.

Robert is the sole shareholder and CEO of ABC, Inc., an S corporation that is a qualified trade or business. During the current year, ABC has net income of $287,000 after deducting Robert's $86,100 salary. In addition to his compensation, ABC pays Robert dividends of $200,900.

a. What is Robert's qualified business income?

b. Would your answer to part (a) change if you determined that reasonable compensation for someone with Robert's experience and responsibilities is $181,050?

Answers

Answer:

A. $287,000

B. $192,050

Explanation:

a. Based on the information givenwe were told that company ABC had net income of the amount of $287,000 after deducting Robert's salary of the amount of $86,100 which therefore means that ROBERT'S QUALIFIED BUSINESS INCOME will be the amount of $287,000.

b. Calculation to determine whether your answer to part (a) would change if you determined that reasonable compensation for someone with Robert's experience and responsibilities is $181,050

Based on the information given the amount of $192,050 will be the additional amount of salary that can be deducted which is Calculated as:

=[$287,000 - ($181,050-$86,100)]

=$287,000-$94,950

=$192,050

Cusic Music Company is considering the sale of a new sound board used in recording studios. The new board would sell for $24,700, and the company expects to sell 1,640 per year. The company currently sells 1,990 units of its existing model per year. If the new model is introduced, sales of the existing model will fall to 1,660 units per year. The old board retails for $23,100. Variable costs are 53 percent of sales, depreciation on the equipment to produce the new board will be $1,035,000 per year, and fixed costs are $3,250,000 per year. If the tax rate is 24 percent, what is the annual OCF for the project

Answers

Answer: $9,524,922

Explanation:

The annual OCF of the project will be calculated as

= EBIT + Depreciation - taxes

First, we have to calculate the EBIT which will be:

= [ $24,700 x 1,640 - ( 1,990-1,660 x $23,100 ]

= $40,508,000 - (330 × $23100)

= $40,508,000 - $7,623,000

= $ 32,885,000

Variable cost will then be:

= $32,885,000 × 53%

= $32,885,000 x 0.53

= $ 17,429,050

Therefore, EBIT will be:

= $32,885,000 - $ 17,429,050 - Fixed cost - depreciation

= $32,885,000 - $ 17,429,050 - $3,250,000 - $1,035,000

= $11,170,950

Then, we calculate the value of tax which will be:

= $11,170,950 x 0.24

= $2,681,028

Therefore, OCF will be:

= EBIT + Depreciation - taxes

= $11,170,950 + $1,035,000 - $2,681,028

= $9,524,922

ouvenir sheets to stamp collectors. The postal service purchases the souvenir sheets from a supplier for $1.80 each. St. Vincent has been selling the souvenir sheets for $14.00 each and ordinarily sells about 100,000 units. To test the market, the postal service recently priced a new souvenir sheet at $12.60 and sales increased to 114,000 units. Required: 1. What total contribution margin did the postal service earn when it sold 100,000 sheets at a price of $14.00 each

Answers

Answer:

Total contribution margin= $1,220,000

Explanation:

Giving the following information:

Purchase price= $1.8

Selling price= $14

Number of untis= 100,000

First, we will determine the unitary contribution margin:

Unitary contribution margin= selling price - unitary variable cost

Unitary contribution margin= 14 - 1.8

Unitary contribution margin= $12.2

Now, the total contribution margin:

Total contribution margin= 100,000*12.2

Total contribution margin= $1,220,000

Empire Electric Company (EEC) uses only debt and common equity. It can borrow unlimited amounts at an interest rate of rd = 11% as long as it finances at its target capital structure, which calls for 45% debt and 55% common equity. Its last dividend (D0) was $1.85, its expected constant growth rate is 3%, and its common stock sells for $22. EEC's tax rate is 25%. Two projects are available: Project A has a rate of return of 13%, and Project B's return is 10%. These two projects are equally risky and about as risky as the firm's existing assets. What is its cost of common equity? Do not round intermediate calculations. Round your answer to two decimal places. % What is the WACC? Do not round intermediate calculations. Round your answer to two decimal places. % Which projects should Empire accept? -Select-

Answers

Answer:

11.66

7.6475

project A

Explanation:

According to the survey article on mergers by Mukherjee et al,

A) a minority of managers believe that diversification can be a good reason to merge.

B) acquiring managers discount targets’ cash flows at the targets’ cost of capital.

C) managers do not believe operating synergies to be important in merger decisions.

D) managers do not use the discounted cash flow formula to value a target in a merger.

Answers

Although RICO was passed to prevent gangsters from taking money they earned illegally and investing it in legitimate businesses, it is now often used against businesspeople who break the law.

a) true

b) false

Answers

Most agency matters are resolved through adjudication.

False

True

Answers

Most agency matters are resolved through adjudication.

True.

Answer:

true is the required answer for your question

hope it helps you